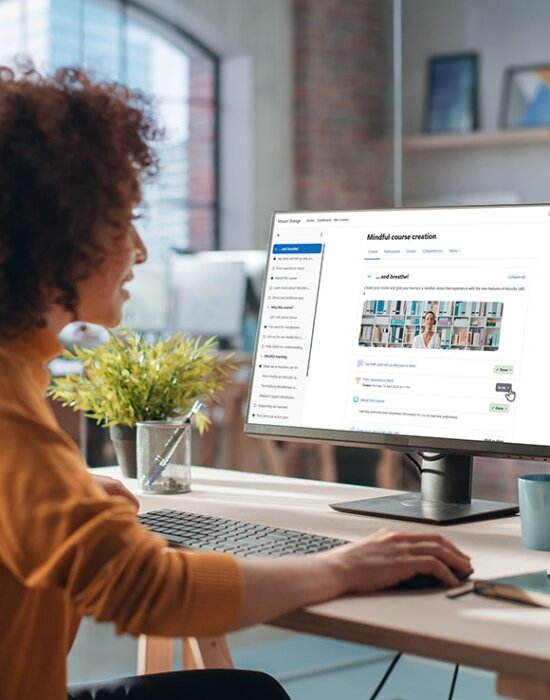

Moodle puts the power of eLearning in your hands

At Moodle, our mission is to empower educators to improve our world with our open source eLearning software.

Flexible, secure, and customisable for any online teaching or training initiative, Moodle gives you the freedom to create an eLearning platform that best meets your needs.

Customise your learning experience

With a wide range of inbuilt features, plugins, and integrations at your disposal, you can create any course or learning environment you envision with Moodle.

Scale your platform to any size

From small classrooms to large universities, global companies, and government departments, Moodle can be scaled to support organisations of all sizes.

Safeguard your LMS data and systems

As an open source platform, Moodle is committed to safeguarding data security, user privacy, and security controls. For complete control, Moodle can be easily deployed on a private secure cloud or server.

Use anywhere, on any device

With a mobile-compatible interface and cross-browser compatibility, content on the Moodle platform is easily accessible, available offline, and consistent across different web browsers and devices.

Tap into specialist LMS support

Get your LMS set up and serviced for you by a Moodle Certified Partner or Service Provider of your choice.

Choose your online learning platform

Building better learning experiences with Moodle

Who’s using Moodle?

What our customers say

Here to help you succeed

Wherever you are in the world, there’s a Moodle expert near you who can provide help. From site setup and hosting, to customisations and training, unlock unparalleled expertise and dedicated support 24/7 through our global network of Moodle Certified Partners and Service Providers.

Ready to go?

Need advice?

Explore our latest releases